By Nicolás Longo

(As an Amazon Associate we earn from qualifying purchases)

Bookkeeping Books: The Essential Guides for Financial Clarity

For anyone looking to master the fundamentals of financial record-keeping, Bookkeeping Books are an invaluable resource. These comprehensive guides cover everything from basic principles to advanced techniques that ensure accuracy and accountability in managing your finances. Whether you’re a small business owner, an aspiring accountant, or simply interested in understanding the backbone of every successful enterprise, investing in quality Bookkeeping Books can transform the way you handle financial data.

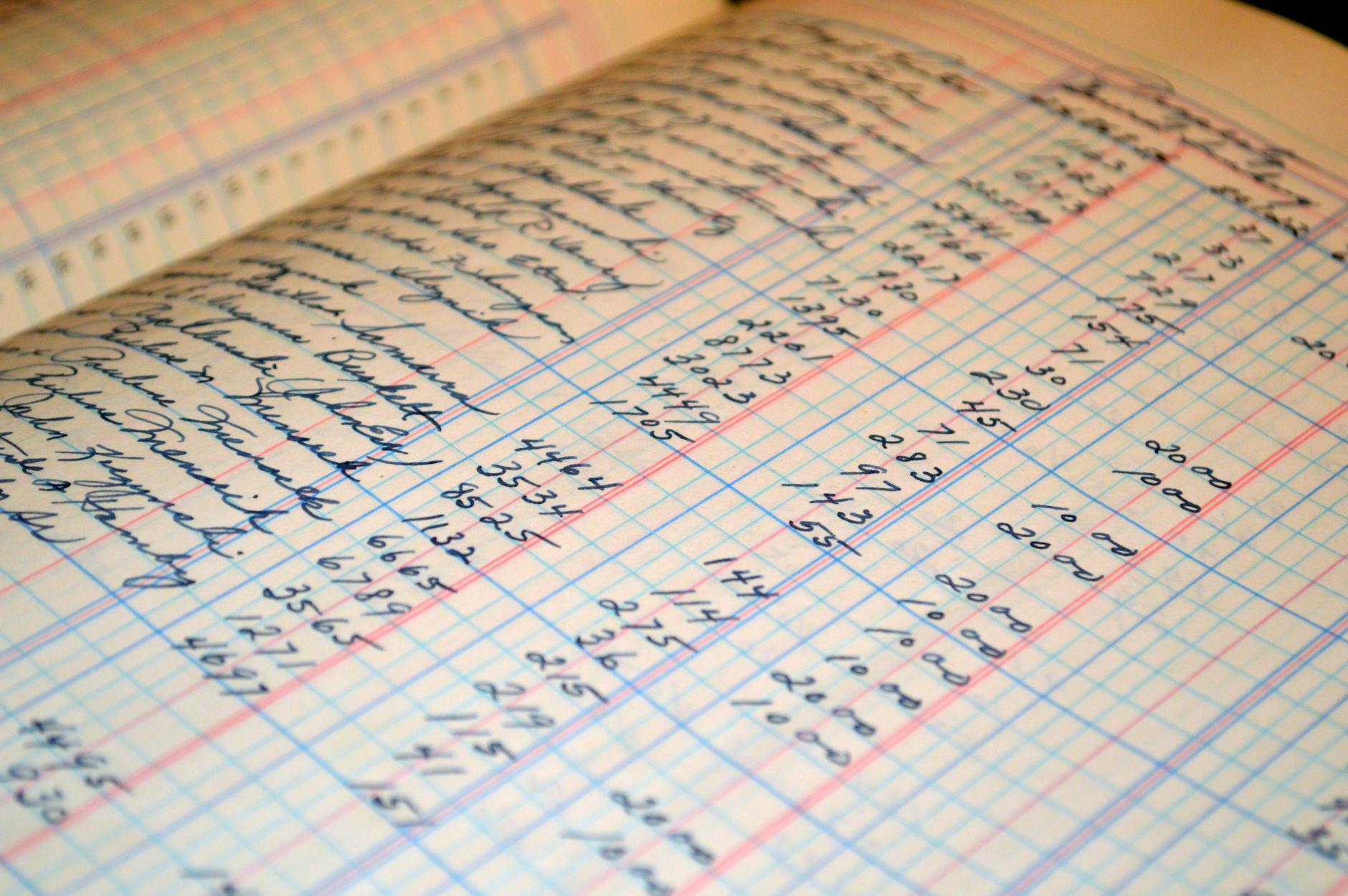

Bookkeeping Books provide clear, step-by-step instructions on how to record transactions, manage debits and credits, and create financial statements. They break down complex concepts such as double-entry accounting and trial balances into understandable segments. Many professionals credit their financial career breakthroughs to the insights gained from well-written Bookkeeping Books that simplify intricate processes into digestible lessons. Fun fact: early pioneers in accounting relied on handwritten ledgers, a precursor to today’s digital systems detailed in modern Bookkeeping Books.

In addition to technical skills, these guides often offer historical perspectives and practical case studies that demonstrate the evolution of bookkeeping practices. Readers learn not only the “how” but also the “why” behind financial principles, fostering a deeper appreciation for the role that accurate record-keeping plays in business success. For instance, some Bookkeeping Books highlight real-world examples that show how meticulous records can prevent costly errors and fraud. Such resources empower you to implement best practices, whether you’re using traditional ledgers or modern accounting software.

Understanding the importance of Bookkeeping Books extends beyond number crunching—it’s about creating a reliable financial narrative for your business. These texts help you build a solid foundation for budgeting, forecasting, and strategic planning by ensuring that every transaction is accurately documented. Data from industry experts suggest that companies using structured bookkeeping systems experience significantly better financial stability and growth. Therefore, the guidance found in Bookkeeping Books not only sharpens your technical skills but also supports sound decision-making and long-term business success.

Top 10 Best Bookkeeping Books

- Epstein, Lita (Author)

- English (Publication Language)

- 576 Pages – 08/27/2019 (Publication Date) – For Dummies (Publisher)

- Von Fumetti, Bill (Author)

- English (Publication Language)

- 148 Pages – 04/06/2023 (Publication Date) – Transcendent Publishing (Publisher)

- Weinstein, Eric A. (Author)

- English (Publication Language)

- 244 Pages – 01/05/2024 (Publication Date) – Labyrinth Learning (Publisher)

- Epstein, Lita (Author)

- English (Publication Language)

- 6 Pages – 11/01/2020 (Publication Date) – Quickstudy (Publisher)

- Manufacturer: Dome

- Simplified Monthly Bookkeeping Record

- Easy accounting for small business

- 128 pages, wire bound

- Undated—start anytime

- Record of cash received and paid out

- Package Weight : 0.295 kilograms

- Free access to bookkeeping forms

- Mucha-Aydlott, Julie (Author)

- English (Publication Language)

- 441 Pages – 02/17/2020 (Publication Date) – JA Publications, Ltd. (Publisher)

- Epstein, Lita (Author)

- English (Publication Language)

- 368 Pages – 12/31/2014 (Publication Date) – For Dummies (Publisher)

- Bragg, Steven M. (Author)

- English (Publication Language)

- 352 Pages – 04/26/2011 (Publication Date) – Wiley (Publisher)

- McCarthy, Robert (Author)

- English (Publication Language)

- 124 Pages – 07/31/2020 (Publication Date) – Independently published (Publisher)

Elevate Your Financial Management with Bookkeeping Books

Bookkeeping Books are more than just manuals; they are keys to unlocking financial transparency and efficiency. They explain critical concepts such as the accounting equation, balance sheets, and income statements in a way that is accessible to beginners and beneficial to seasoned professionals. By studying these resources, you can learn how to reconcile accounts, prepare for audits, and even navigate the complexities of tax regulations. Detailed chapters in Bookkeeping Books often include practical exercises, examples, and illustrations that help solidify your understanding of each topic.

A common thread in high-quality Bookkeeping Books is their focus on both theory and practical application. They provide insights into common pitfalls and offer strategies to avoid errors that could lead to financial mismanagement. For example, by understanding the double-entry system explained in these books, you can ensure that your records remain balanced and accurate. This rigorous approach not only boosts confidence but also enhances your reputation as a meticulous financial professional.

Moreover, with the advent of digital accounting, modern Bookkeeping Books also cover the integration of technology into financial practices. They discuss how traditional methods merge with contemporary software solutions, ensuring that you are well-equipped to handle both paper-based and electronic records. As businesses increasingly rely on automated systems, the lessons from these books become even more critical, enabling you to leverage technology without sacrificing the integrity of your bookkeeping.

Embracing the knowledge shared in Bookkeeping Books can dramatically improve how you manage financial data. These resources are designed to be both practical and inspiring, giving you the tools to take control of your finances and drive business success. The clarity and precision offered by these guides empower you to tackle complex financial challenges and build a robust accounting framework that supports sustainable growth.

By integrating the lessons from top-rated Bookkeeping Books into your daily practices, you are investing in a future where financial decisions are made with confidence and precision. This commitment to excellence not only streamlines your operations but also fosters trust with stakeholders, ultimately contributing to a healthier bottom line.

“As an Amazon Associate we earn from qualifying purchases.”